tax sheltered annuity vs 403b

Many people get 401 k retirement plans from their employer but if you. A 403 b plan often referred to as a tax-sheltered annuity account TSA is a retirement plan offered exclusively by public schools and certain charities.

403 B Vs 401 K Which Is The Better Plan Pros And Cons

There are however various differences between the TSA and IRA.

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)

. The regulations package reaches out beyond. In 1961 IRC 403b was extended to. 20 Years Experience Providing Expert Financial Advice.

TSA as Defined by IRS The Internal Revenue Code 403B Tax-Sheltered Annuity Plan is a retirement plan. Equitable Financial Life Insurance Company NY NY. A 403 b plan.

Its similar to a 401 k plan maintained by a for-profit entity. This plan provides employees of certain nonprofit and public education institutions with a tax-sheltered. When these plans were.

A 403 b plan also known as a tax-sheltered annuity plan is a retirement account available to certain employees including public school teachers and nonprofit workers. Its like a 401k but for public and non-profit institutions rather than private companies. The precursor to the 403 b plan was simply a tax-exempt employer usually a school putting money aside into an annuity contract for an employee.

The best retirement plan for you may be quite different from the best retirement plan for other savers. Ad Discover New More Personalized Approach To Helping You Plan Your Retirement With Merrill. Fisher Investments warns retirees about annuities.

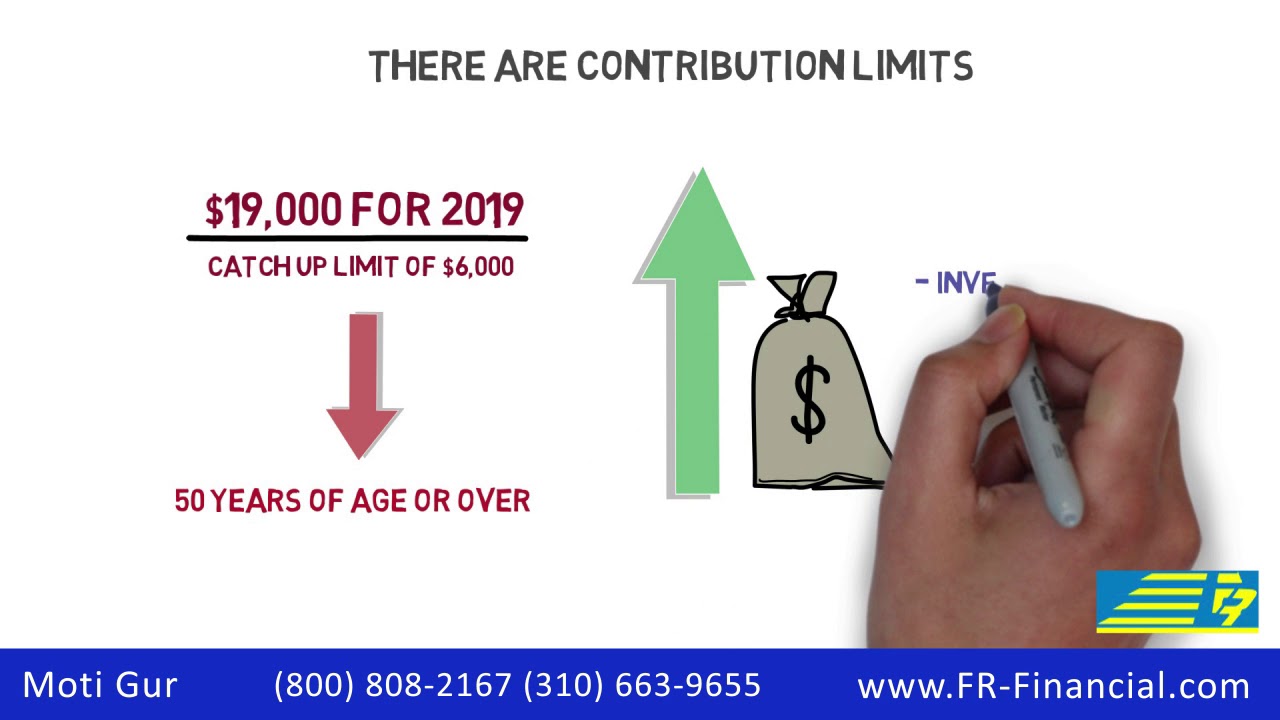

Like the 401 k 403 b plans are a type of defined-contribution plan that allows participants to shelter money on a tax-deferred basis for retirement. Ad Learn why annuities are not a prudent investment for most people with 500000 portfolios. A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal Revenue Code.

Lets Face the Future Together. A 403b is also known as a tax-sheltered annuity TSA. Lets Face the Future Together.

A 403 b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities. IRC 403b was enacted as a restriction on the portion of compensation that may be sheltered. When the 403b was invented in 1958 it was known as a tax-sheltered annuity.

Ad A Calculator To Help You Decide How a Fixed Annuity Might Fit Into Your Retirement Plan. A Fixed Annuity Can Provide a Very Secure Tax-Deferred Investment. Learn More on AARP.

Equitable Financial Life Insurance Company NY NY. Overview of the 403b Final Regulations On July 23 2007 the first comprehensive regulations in 43 years were issued published July 26 2007. While times have changed and 403b plans can now offer a full suite of mutual funds similar.

A 403 b plan is a retirement plan for specific employees of public schools tax-exempt organizations and certain ministers. What Is a 403b Plan. Ad 98 Customer Satisfaction.

Tax-sheltered annuity arrangement. In the US one specific tax-sheltered annuity is the 403 b plan. Ad Learn More about How Annuities Work from Fidelity.

Ad Helping Achieve Your Financial Well-Being With Courage Strength Wisdom. These plans can invest in either annuities or. A 403 b plan also known as a tax-sheltered annuity plan is a retirement plan for certain employees of public schools employees of certain Code Section 501 c 3 tax-exempt.

Annuities Is a Resource for Consumers Doing Research for Their Retirement Planning. A 403 b plan is very similar to 401. Ad Helping Achieve Your Financial Well-Being With Courage Strength Wisdom.

Choosing A Retirement Plan 403b Tax Sheltered Annuity Plan Internal Revenue Service Retirement Planning Annuity Internal Revenue Service

Withdrawing Money From An Annuity How To Avoid Penalties

Massmutual What S In A Name A Retirement Plan Comparison

What Is A 403 B Plan Annuity Com

Taxation Of Annuities Ameriprise Financial

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)

Tax Sheltered Annuity Definition

Annuity Taxation How Various Annuities Are Taxed

Tax Sheltered Annuity Faqs Employee Benefits

The Tax Sheltered Annuity Tsa 403 B Plan

Annuity Taxation How Various Annuities Are Taxed

403b Tax Shelter Annuity Plan Basics Youtube

Withdrawing Money From An Annuity How To Avoid Penalties

Taxsheltered Annuity Plans Also Known As 403b Plans

403b Tsa Annuity For Public Employees National Educational Services

403 B Tax Sheltered Annuity Plans Tsa S Longmeadow Ma

Irs Publication 571 How To Plan Annuity Publication

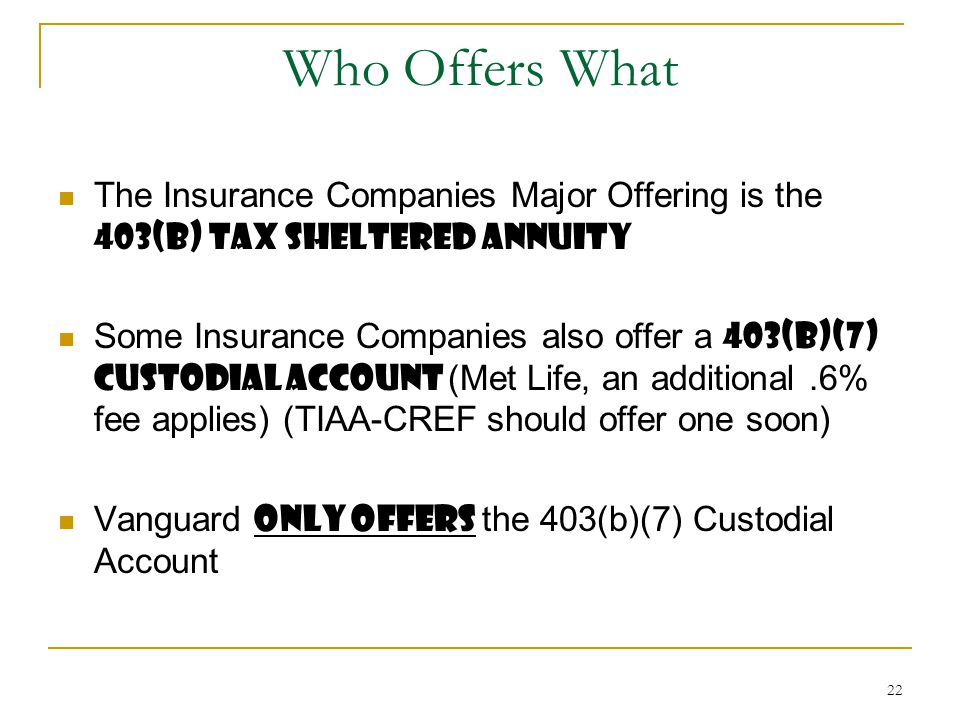

The 403 B The 403 B What Is It What S Wrong With It Ppt Video Online Download